The second week of session is now behind us. Only sixteen more to go! I fully expect this session will continue until the 120th day, May 17, 2022, or very close to it. At this point, I would be very surprised if we went into special session. Most legislators I’ve talked to are not interested in a repeat of last year. I will update you if/when this changes.

I have had two finance sub-committees added to my schedule. I will now be participating on the finance sub-committees for the Departments of Fish and Game and Natural Resources. These assignments are in addition to the finance sub-committees for the Departments of Transportation and Public Facilities, Department of Administration, and the University of Alaska that I already sit on.

The last two weeks of House Finance Committee (HFIN) included informational briefs from the Departments of Natural Resources (DNR) and Revenue (DOR), The Office of Management and Budget (OMB), Legislative Finance Division (LFIN), Callan & Associates, and the Permanent Fund Corporation (APFC). For those interested in reviewing the presentations, they are provided here:

Callan & Associates Video Slides

Below I have provided a summary of DOR’s Fall 2021 Revenue Forecast with some of the more important information and a couple takeaways I want to share.

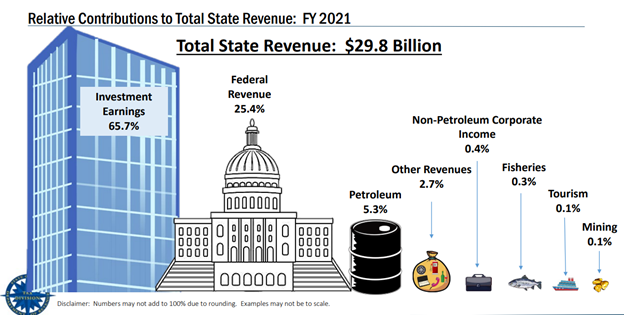

The ‘Relative Contributions to Total State Revenue’ graphic (page 7) shows the relationship between different sources of state revenue for FY21 (ending June 30, 2021). The three largest sources of revenue in order were permanent fund earnings, federal funds, and petroleum revenue. The part of the graphic detailing the 65.7% investment earnings reflects all investment funds, including the permanent fund, as a portion of the total state revenue. The permanent fund rate of return was an incredible 29.7% with earnings of approximately $19.37 billion!

On a side note, most Alaskans work in the economy represented by the revenue sources on the right side of the petroleum revenue. There is a disconnect between the main sources of state revenue and the economic engine that most Alaskans rely upon for their livelihood. This disconnect is also felt in the legislative budget process because focus and attention are on spending the finite sources of revenue and not on growing the economic engine.

A more stable long-term fiscal plan would correct this disconnect by tying state revenue to the economic engine most Alaskans rely upon. Doing so would incentivize legislative policies that grow our economy rather than relying upon the redistribution of federal tax dollars and expenditure of investment earnings that are completely disconnected from everyday Alaskan’s lives. HJR 23, sponsored by Representative Kaufman, ties our constitutional spending limit to our state’s GDP and is an example of linking our economic engine with government spending.

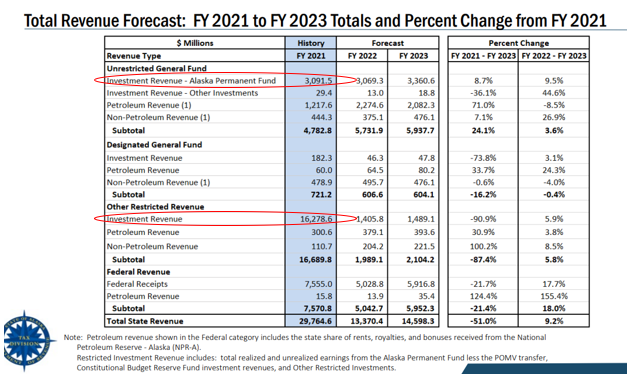

Permanent fund revenue spent on state government last fiscal year (FY21) totaled $3.091 billion; is forecast to provide $3.069 billion for the current fiscal year (FY22), and $3.360 billion for next fiscal year (FY23).

The portion of that annual $3 billion figure that is spent on permanent fund dividends each year is the question the legislature wrestles with each budget cycle because we choose not to follow the statute (AS 37.13.145 (b)) that directs 50% of the number to be transferred, I repeat, TRANSFERRED, to the dividend fund by the permanent fund corporation.

Another side note, there is legislation pending by the House majority this session that would remove all reference to the word “transfer” from the permanent fund statutes – to be replaced with the word “appropriate.”

History may record this action as the completion of one of the greatest miscarriages of justice and usurpation of authority by the judicial branch in the Wielechowski vs. Alaska case. The court determined in 2017 that the annual PFD payment isn’t a transfer but an appropriation, paving the way for the Legislature to not pay a statutorily required dividend payment in subsequent years.

HB 249 seeks to replace the words “transfer” in the same statute the courts referenced in 2017 when it determined the PFD payment wasn’t a transfer. These words were chosen by the legislature to mean transfer and that is exactly what they meant for decades. The 2017 court ruling redefined transfer to mean appropriate. The court lacked the power in 2017 to strike the actual words “transfer” from the statute. For that to occur, the legislature must be complicit with the court in redefining a transfer to mean an appropriation.

For a more in-depth understanding, here is a link to an Administration document that describes the statutes and administrative codes that make up the Permanent Fund Dividend Program. To gain a full understanding of the program, you must also understand the statutes that created the Permanent Fund Corporation, AS 37.13.010 – AS 37.13.900, and direct the corporation’s actions, including the transfer of income to the dividend account and a transfer of funds to inflation-proof the permanent fund – in that order.

My Takeaways

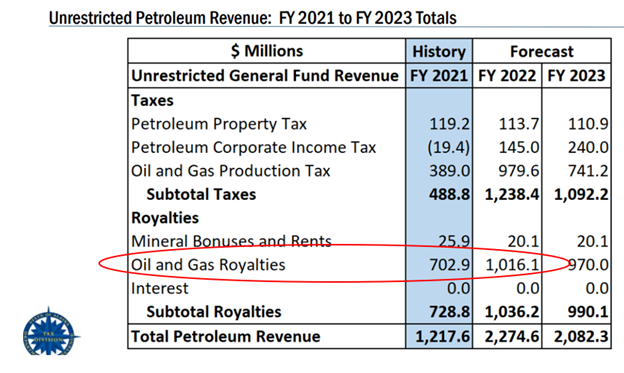

Firstly, FY22 is projected to generate approximately $1 billion in surplus oil and gas royalties to the state. This is the state’s portion of the oil and gas royalties. Constitutionally, the other portion (25%) of oil and gas royalties are transferred automatically into the permanent fund, and statutorily another portion (approximately 25%) is also transferred into the permanent fund.

According to state auditors (page 4, Comprehensive Annual Financial Report), approximately $100 million in FY18 and $100 million in FY19 of oil and gas royalties were not transferred to the permanent fund as required by law. These sums were retained in the General Fund and spent on state services. I believe FY18 & FY19 back-payments need to be made immediately from the $1 billion in FY22 royalty surplus because that error needs to be corrected. Doing so also provides future generations permanent fund growth that they are entitled to.

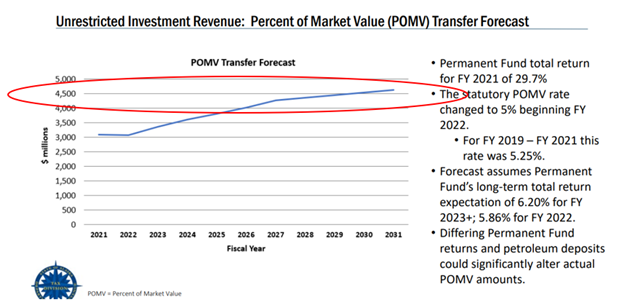

Secondly, in reference to long-term fiscal solutions, FY30 permanent fund earnings are projected to be $4.5 billion (with continued 6% investment returns), as can be seen on the ‘POMV transfer forecast’ graphic (page 13). Compare those projected investment earnings with the $4.8 billion Total Unrestricted General Fund (UGF) revenue from FY21.

The projected permanent fund earnings amount is significant because it is comparable to the current amount of our entire UGF revenue (oil & gas revenue, non-oil & gas revenue, and investment earnings). This may be our future a short eight years from now. This milestone has some potentially huge ramifications.

Long-term plans of some in the legislature are focused on the eventuality of $5 billion POMV payments and hopes are high that state government will soon have a “free” source of revenue from our permanent fund adequate to fund most government programs. The focus for many, is and always will be, spending available revenue on government solutions. Legislative focus is rarely upon growing the economy where Alaskans work and live. As we heard in HFIN, there is risk that the permanent fund will not always perform at a level necessary to sustain state spending, just as there is risk that oil revenue will not always be adequate to cover all state spending.

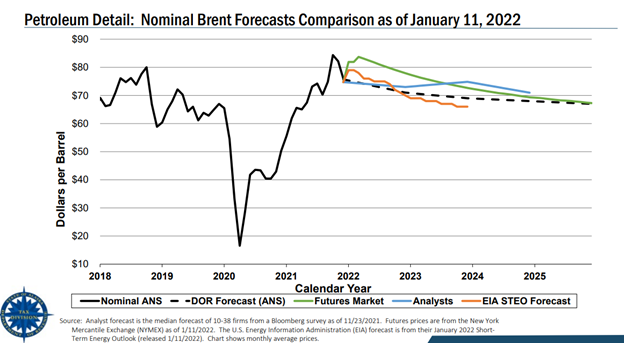

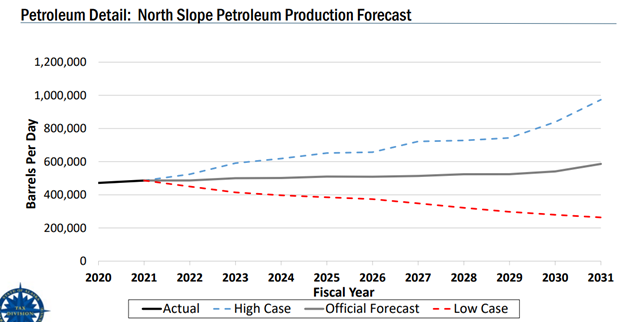

Speaking of oil and gas revenue, here are updated oil price and production forecasts.

You ought to ask yourself if you think legislators will care what happens in your economy when their government is completely paid for with investment earnings and federal funds. You ought to also ask yourself if oil and gas revenue, and the associated jobs and economic benefit, will be needed by legislators when permanent fund earnings are sufficient to replace oil and gas revenue.

I’ll get back to this concept in a moment.

Some members on the Finance Committees, and surely others within the legislature, are salivating at the prospect of having what amounts to current total annual UGF revenue coming annually from the permanent fund. This is the main reason why many people strongly favor growing the fund to $100 billion as quickly as possible.

What’s wrong with investment earnings paying for state government you might ask?

The Problem

State (and federal) policies friendly to future oil production, and Alaska jobs, only matter to policymakers if the state (and federal) government needs oil and gas revenue, or the resource itself. If declining oil revenue and growing permanent fund earnings is part of the long-term fiscal picture for Alaska, it’s only a matter of time before Alaskans don’t technically need oil & gas revenue to pay for state government. It is conceivable that national and international political pressure may make oil & gas development cost prohibitive in the future. And technically speaking, we already have the infrastructure to sustain Alaska’s domestic demand for petroleum products with imported refined product.

The green new deal isn’t the only threat to oil and gas jobs in Alaska. Permanent fund earnings that replace oil and gas revenue will be the one-two punch that kills our oil industry.

If the green new deal is here to stay, where will the Alaska economy be when receiving federal funds becomes contingent on policies that phase out oil & gas development? Do you care to wager a bet on where state policymaker focus will be when $5+ billion of annual federal funds has strings attached to reductions in oil & gas production?

In a future where oil & gas revenue isn’t necessary to pay for state budgets because permanent fund earnings have supplanted oil & gas revenue, our oil & gas industry will be vulnerable to hostile legislative action. The legislature will comply with federal strings attached to our annual federal receipts… unless you believe that legislators will have the will to say no to federal funds?

There are many factors that influence state and federal oil & gas policy decisions, and this is perhaps an oversimplification of the problem. There are also reasons to believe that demand for oil & gas will continue to be strong into the future. But there is no denying that the direction the whole world is driving is to eliminate fossil fuel usage. Oil & gas production may continue long into the future, but it doesn’t have to come from Alaska.

We should all be concerned about the recent Alaska Supreme Court ruling in Summer Sagoonick v. State of Alaska. In a 3-2 ruling, the Supreme Court upheld the lower court dismissal leaving the issue of climate change with the other branches of government. Industry representatives have shared with me that this is good news! And I agree. But I also see danger.

Sean Maguire, in an Alaska News Source Article, highlighted part of the dissenting opinion from Justices Peter Maassen and Susan Carney where they argued “that the “maximum benefit” provision [of the Alaska Constitution] could also imply the need for the conservation [of our natural resources]” and thus the court should have found in favor of the plaintiffs.

To further highlight just how precarious Alaska’s oil & gas development policies are, consider these words from the dissenting opinion:

[The court’s] “…grant of declaratory relief here will not forestall future litigation over the same or similar issues. Litigation over the government’s role in addressing climate change is still in its infancy, and more challenges to state action based on its potential for worsening the crisis are not just likely but certain, regardless of how we resolve this case.”

“The court today takes a very narrow view of both the rights granted by article VIII [in the Alaska Constitution] and our role in protecting those rights. The court is concerned that recognizing an individual right to a livable climate would impinge on the legislative prerogative to manage the State’s natural resources for the benefit of all Alaskans. But the Constitution recognizes individual Alaskans’ rights vis-á-vis the State and their fellow citizens in a number of different contexts. The judiciary acts within its delegated role when it concludes that the legislature, despite its broad article VIII powers, has violated individual Alaskans’ article VIII rights. And as the court acknowledges, we also act within our delegated role when we determine that an agency, despite having taken the requisite “hard look at the salient problems,” has reached a decision that infringes a constitutional right. We cannot exercise that oversight effectively without first defining the individual rights that may be implicated.”

[In the dissenter’s view] “the law requires that the State, in pursuing its energy policy, recognize individual Alaskans’ constitutional right to a livable climate. A declaratory judgment to that effect would be an admittedly small step in the daunting project of focusing governmental response to this existential crisis. But it is a step we can and should take.”

With the difference of a single supreme court justice, the future court may very well read into the constitution an individual constitutional right to a livable climate and for the maximum benefit of all Alaskans, direct the legislature and/or the executive branch to modify state energy policies accordingly.

Alaska’s economy needs to diversify and grow, and our state revenue structures need to change to enable that growth. Oil & gas needs to be only one of many industries creating a diversified and more resilient economy.

Few legislators want to solve our structural imbalance with taxes alone. Also true, not enough legislators want to reduce state spending to a level that is sustainable with current revenue. So, the legislature continues to wallow in acrimony and deadlock. That which is damaged most by our continued disfunction is our economic engine because of the opportunity cost of inaction.

Leadership is needed.

The Fiscal Policy Working Group provided recommendations to the legislature last August. This is a great place to start for finding a solution to our structural problems.

More to follow.